This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Income from RM2000001.

Malaysia Indirect Tax Revenue Statista

For 2021 tax year.

. United Arab Emirates 1605 GDP YoY Forecast. 26 July 2021. The California Department of Tax and Fee Administration CDTFA collects taxes and fees that account for more than 30 percent of the annual revenue for state government.

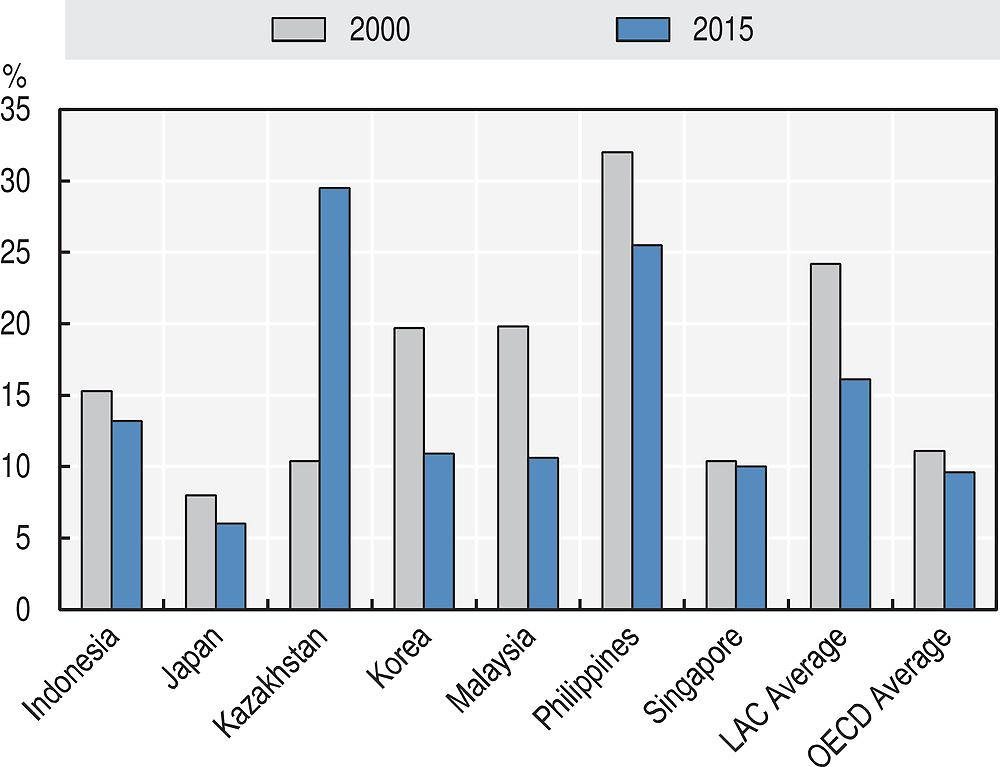

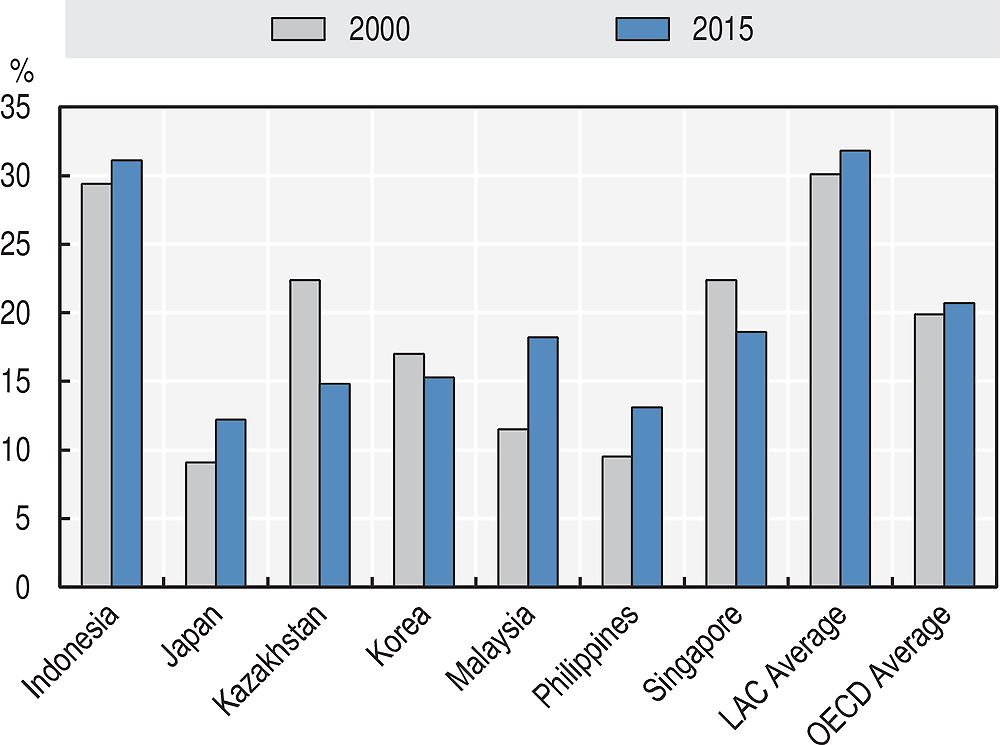

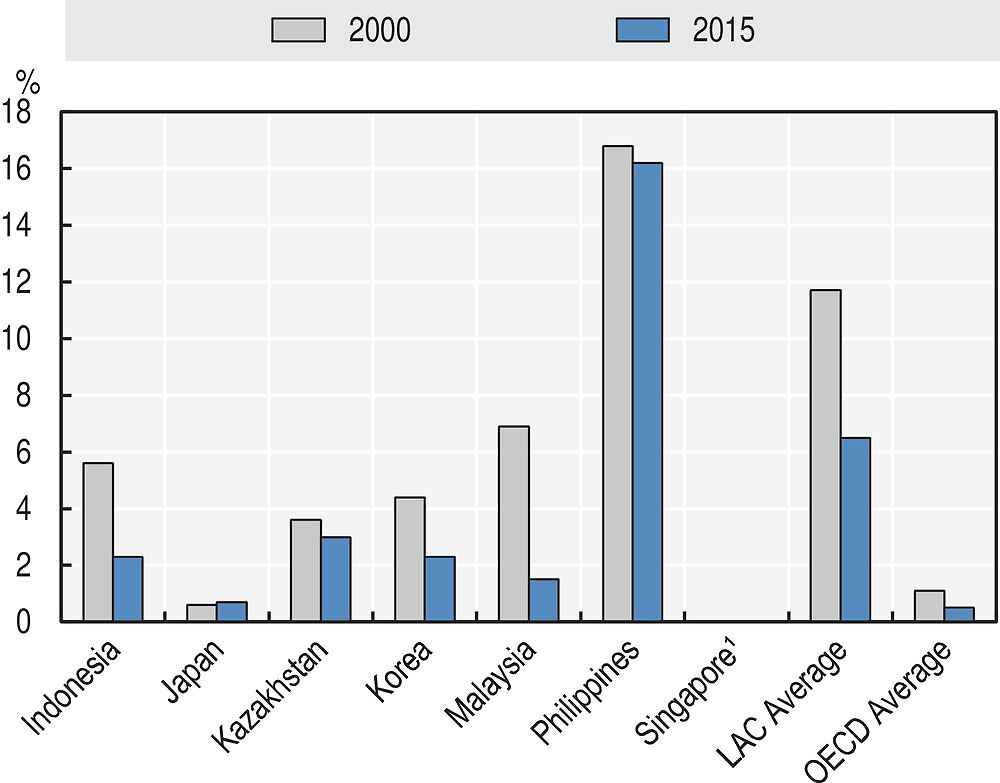

It compiles comparable tax revenue statistics for Indonesia Japan Kazakhstan Korea Malaysia the Philippines and Singapore. In Malaysias context income tax is the most significant direct tax. English Also available in.

With issues of race and religion continuing to dominate the Malaysian political and social landscapes it appears that even taxes are not spared. Malaysia located in Southeast Asia is separated by the South China Sea into two non-contiguous regions. Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers.

Jan 19 2022 In 2020 the total amount of direct tax revenue in Malaysia amounted to around 11511 billion Malaysian ringgit a decrease from the previous year. The model is the OECD Revenue Statistics database which is a fundamental reference backed by a well-established methodology for OECD member countries. Malaysia Residents Income Tax Tables in 2020.

Taxable Income MYR Tax Rate. For that indicator we provide data for Malaysia from 1996 to 2019. Tax revenue percent of GDP.

It compiles comparable tax revenue statistics for Indonesia Japan Kazakhstan Korea Malaysia the Philippines and Singapore. 102 rows Chapter 3 - Table 315 - Tax revenues of subsectors of general government as of. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system.

03-8888 9248 Email. This dataset contains tax revenue collected by Malaysia. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

In doing so the CDTFA produces valuable data that can assist policy makers economists researchers and the business community at large to better understand Californias. The Peninsula Malaysia region bordering Thailand ie. 24 rows The value for Tax revenue current LCU in Malaysia was 180566000000 as of 2019.

Like many other jurisdictions Malaysia has its own taxation system. For 2019 the government is estimated to collect RM1899 billion in taxes with direct income tax at RM1238 billion 69 per cent SST at RM268 billion 15 per cent other direct tax at RM117 billion 6 per cent and other indirect tax at RM175billion 10 per cent. National Accounts Source Detail.

Oecdglobal-rev-stats-database Malaysias tax-to-GDP ratio was 124 in 2019 below the Asia and Pacific 24 average of 210 by 86 percentage points. Tax rates range from 0 to 30. MALAYSIAN ECONOMY IN FIGURES Revised as at December 2021 Table of Contents iii 1 KEY ECONOMIC INDICATORS Page.

Income from RM500001. Mohd Yusrizal Ab Razak Public Relation Officer Strategic Communication and International Division Department of Statistics Malaysia Tel. The Inland Revenue Board IRB.

The tax-to-GDP ratio in Malaysia did not change between 2018 and 2019 and remained at 124 of GDP in both years. 141 Income Tax Rate 54 142 Promotion of Investment Act 54 143 Income Tax Act 54 144 Others 54. Due to the lower tax collection the government had to rely on revenue.

West Malaysia and the Malaysia Borneo region bordering Indonesia and Brunei ie. A company will be a Malaysian tax resident if at any time during the basis year the. It was also below the OECD average 338 by 214 percentage points.

Malaysia Personal Income Tax Rate was 30 in 2022. Infodosmgovmy general enquiries datadosmgovmy. CHIEF STATISTICIAN MALAYSIA DEPARTMENT OF STATISTICS MALAYSIA DrUzir_Mahidin Dr_Uzir.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Department of Statistics Malaysia Block C6 Complex C Federal Government Administrative Centre 62514 PUTRAJAYA Tel. Malaysia is divided into 13 states and three federal territories with Kuala.

Government Revenues in Malaysia increased to 8808330 MYR Million in the fourth quarter of 2021 from 5145450 MYR Million in the third quarter of 2021. And Revenue Statistics in Africa. 03-8885 7000 Fax.

The Malaysian government revenue. That said income of any person other than a resident. As a percentage to GDP tax revenue constitutes 111 while non-tax revenue at 4.

It provides detailed tax revenues by sector Supranational Federal or Central Government State or Lander Government Local Government and Social Security Funds and by specific tax such as capital gains profits and income property sales etc. The average value for Malaysia during that period was 1505 percent with a minimum of 1193 percent in 2019 and a maximum of 1975 percent in. Bank Negara Malaysia Department of Statistics Malaysia Ministry of Finance and World Bank ii.

Income from RM5000001. The model is the OECD Revenue Statistics database which is a fundamental reference backed by a well-established methodology for OECD member countries. Direct tax collection is forecast to increase by 146 to RM1319 billion constituting 557 to total revenue.

Government Revenues in Malaysia averaged 2667430 MYR Million from 1981 until 2021 reaching an all time high of 8808330 MYR Million in the fourth quarter of 2021 and a record low of 2735 MYR Million in the first quarter of. A non-resident individual is taxed at a flat rate of 30 on total taxable income. In 2019 the tax revenue received in Malaysia amounted to approximately 454.

All income accrued in derived from or remitted to Malaysia is liable to tax. 1 Corporate Income Tax 1 2 Income Tax Treaties for the Avoidance of Double Taxation 5 3 Indirect Tax 7 4 Personal Taxation 8 5 Other Taxes 9 6 Free Trade Agreements 10. 10 rows Apr 14 2022.

Income from RM3500001. The higher revenue is largely attributed to better tax revenue collection which is estimated to increase by 138 to RM1744 billion.

The Components Of The Government Revenue In Malaysia Download Table

Malaysia Tax Revenue 1980 2022 Ceic Data

Revenue Statistics 2019 En Oecd

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

2 Australia S Tax System Treasury Gov Au

Malaysia Direct Tax Revenue Statista

Pdf Tax And Revenue Trends And Implications In Malaysia

Norway Tax Revenue 2002 2022 Ceic Data

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Pdf Tax And Revenue Trends And Implications In Malaysia

Revenue Statistics In Asian And Pacific Economies 2019 En Oecd

Pdf Designing Malaysia S Tax Structure To Achieve Higher Income Country

Motor Vehicles The Biggest Taxpayers Followed By Tobacco Products The Edge Markets

Malaysia Tax Revenue Of Gdp 1991 2022 Ceic Data